What Your Small Business Needs to Know

As a small business owner, you may have heard about the new beneficial ownership reporting requirements from the Financial Crimes Enforcement Network (FinCEN). This new regulation affects millions of small businesses across the United States, and the deadline is approaching. Here’s what you need to know to ensure your business stays compliant.

What Is Beneficial Ownership Reporting?

The Corporate Transparency Act (CTA) requires most small businesses to report information about their beneficial owners – the individuals who ultimately own or control the company – to FinCEN. This new requirement is designed to help prevent money laundering, tax fraud, and other financial crimes.

Who Needs to Report?

You must file a beneficial ownership information (BOI) report if your business is:

- A corporation

- Limited Liability Company (LLC)

- Limited Partnership

- Any other entity created by filing with a secretary of state or similar office

- Foreign companies registered to do business in the United States

**Important Note About Sole Proprietorships:**

Most sole proprietorships do NOT need to file a BOI report. You’re only required to file if your sole proprietorship is registered with a Secretary of State, which is uncommon. If you’re operating under your own name or have just filed a DBA (Doing Business As) with your county, you generally don’t need to file a BOI report.

Key Exception: Large Operating Companies

Your business is exempt from reporting if it meets ALL of the following criteria:

- More than 20 full-time employees in the U.S.

- Over $5 million in gross receipts or sales (shown on last year’s tax return)

- Physical operating presence in the United States

What Information Must Be Reported?

For your business, you’ll need to provide:

- Company name and any trade names (DBAs)

- Business address

- State or jurisdiction of formation

- Tax identification number

For each beneficial owner (anyone who owns 25% or more of the company or exercises substantial control), you’ll need to report:

- Full legal name

- Date of birth

- Current residential address

- Unique identifying number (from a passport, driver’s license, or other state ID)

- Image of the identifying document

Important Deadlines

There are two key deadlines to know:

- If your business was registered before January 1, 2024:

– Your report must be filed by January 1, 2025 - If your business is registered on or after January 1, 2024:

– Your report must be filed within 90 days of receiving notice that your company’s formation or registration is effective

Also note that any changes to beneficial ownership information must be reported within 30 days of the change.

How to File

Filing is done through FinCEN’s online portal linked here. The good news? It only takes about 10 minutes to complete and there’s no filing fee. However, failing to file or providing false information can result in civil penalties up to $500 per day and criminal penalties including imprisonment.

Steps to Take Now

- Determine if your business needs to file

- Gather required information about your company and beneficial owners

- Head to FinCEN’s online portal linked here

- Consider consulting with a legal professional if you’re unsure about your obligations

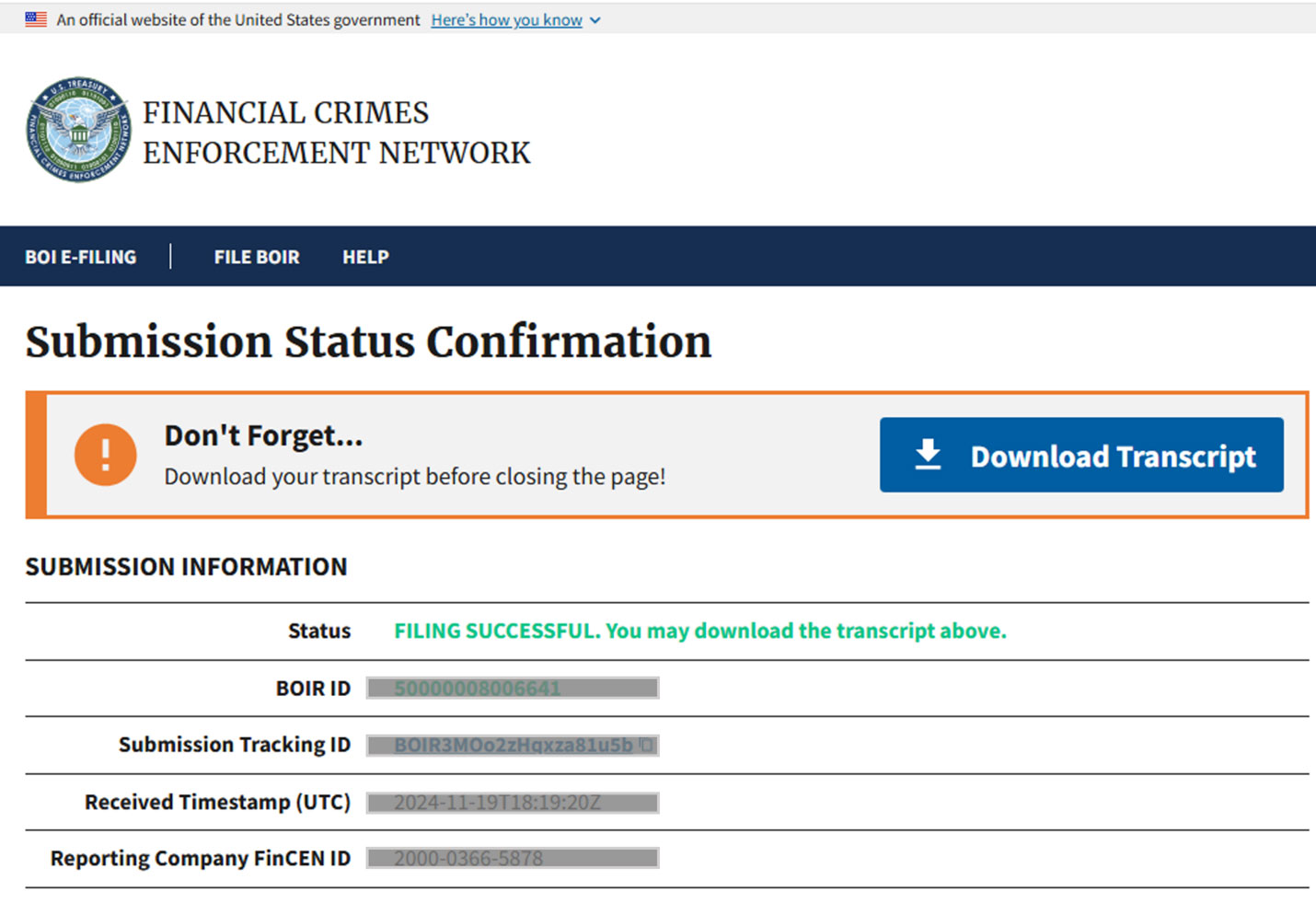

Once you complete the online process, you should see this confirmation screen:

Remember to download the transcript to keep a record of your filing!

Why This Matters

While this new requirement may feel like another administrative burden, it’s part of a larger effort to combat financial crimes and increase transparency in the U.S. financial system. Compliance is crucial to avoid penalties and maintain your business’s good standing.

Remember- you’ve already overcome many challenges in building your business. This is just a new step in your business journey, and there’s plenty of help available to get it done right. Consider reaching out to your loan officer, mentors from one of the local Small Business Development Centers (SBDC) or SCORE, your accountant, or your business advisor to ensure you’re meeting all requirements correctly.

*Disclaimer: This post provides general information about FinCEN beneficial ownership reporting requirements. It is not legal advice. Please consult with a qualified legal professional for advice specific to your situation.*